40+ mortgage interest adjustment california

Web California-based NewFi is a mortgage company authorized to make loans in 24 states. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Lacba 2022 Southern California Directory Of Experts Consultants By Association Outsource Services Inc Issuu

Compare More Than Just Rates.

. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR. Web It imposes a 100000 cap on home equity loans misinterpreting the California rules about home acquisition debt and equity debt.

Web California does not permit a deduction for foreign income taxes. Ad More Veterans Than Ever are Buying with 0 Down. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Using the example above your. There is also no. Compare More Than Just Rates.

They offer a 40-year mortgage with a 10-year interest-only payment. Web Jumbo estimated monthly payment and APR example. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Find A Lender That Offers Great Service. A 940000 loan amount with a 30-year term at an interest rate of 5625 with a down payment of 25. Estimate Your Monthly Payment Today.

Think of it as a little catch up on the interest that accrues on your mortgage between the time you borrow. Federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for married. Find A Lender That Offers Great Service.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Minimum standard deduction 2. Enter amount shown for your filing.

Web California Rules For Mortgage Interest Deduction In the state of California they use the same value that is on an individuals federal tax return. Web The interest adjustment is simply the amount of interest accrued between your closing day and the day your first mortgage payment comes out. Web Thats exactly what an interest adjustment date is for.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Enter the larger of line 1 or line 2 here 3. Enter your income from.

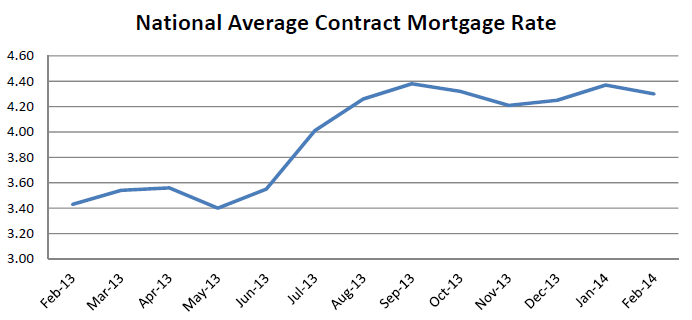

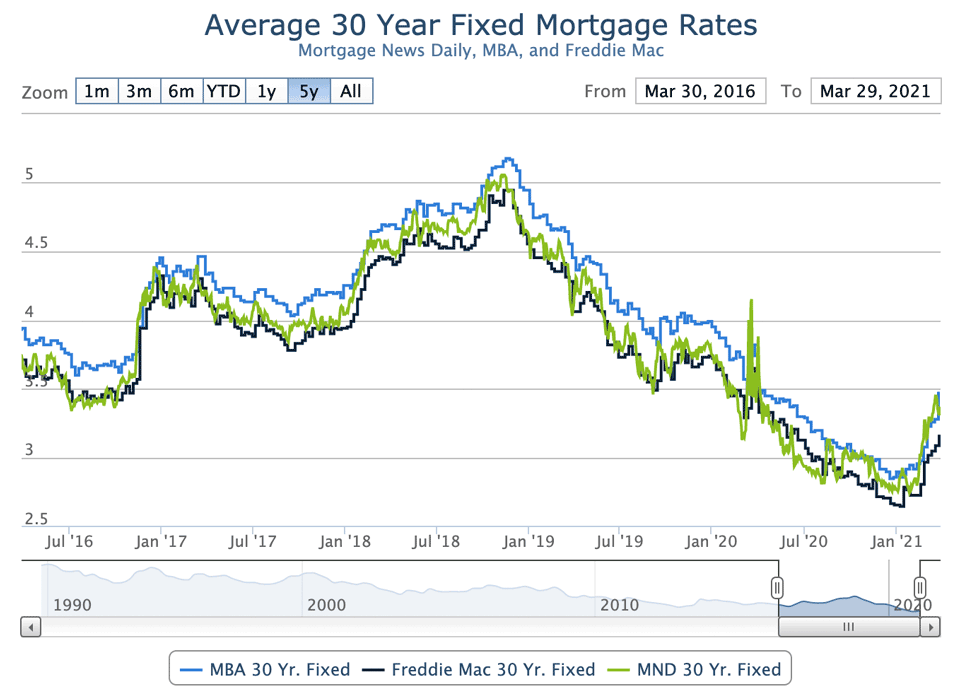

Web Todays mortgage rates in California are 6923 for a 30-year fixed 6129 for a 15-year fixed and 7046 for a 5-year adjustable-rate mortgage ARM.

Social Security Cola For 2023 Biggest Since 1981 Might Finally Outpace Inflation Unless Inflation Dishes Up More Surprises Wolf Street

California Bill Targets Tax Breaks For Wealthy Homeowners Nbc Bay Area

Consumer Bankruptcies Foreclosures Delinquencies And Collections Free Money Still Doing The Job Wolf Street

Tri City News January 26 2023 By Tri City News Issuu

Public Affairs Detail Federal Housing Finance Agency

2px9o86wwtixvm

Federal Register Hud S Proposed Housing Goals For The Federal National Mortgage Association Fannie Mae And The Federal Home Loan Mortgage Corporation Freddie Mac For The Years 2005 2008 And Amendments To Hud S

Q22022ceoletterandpresen

Fat Forty And Fired One Man S Frank Funny And Inspiring Account Of Losing His Job And Finding His Life Marsh Nigel Marsh Nigel 9781449423377 Amazon Com Books

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

California Mortgage Calculator Nerdwallet

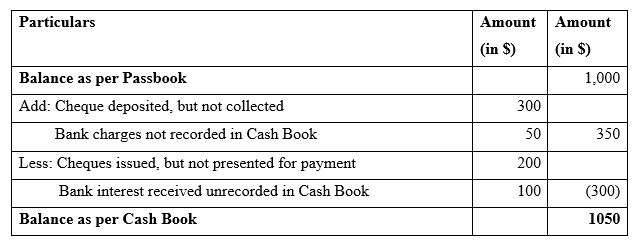

Bank Reconciliation Example Best 4 Example Of Bank Reconciliation

How To Get The Best Mortgage Rates Quora

Mortgage Interest Rates Rise Inventory Falls Benchmark

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

In California Can You Deduct Interest On A Second Mortgage

Pdf Contributions Of Social Factors To Disparities In Prostate Cancer Risk Profiles Among Black Men And Non Hispanic White Men With Prostate Cancer In California